Official Name: Federal Republic of Nigeria

Time Zone: GMT+1h00

Internet Domain: .ng

International Dialing Code: +234

| Location and Size | |

| Government | Credit and Collections |

| Legal System | Risk Assessment |

| People | Business Climate |

| Economy | Business Protocol |

| Economic Indicators | Other Sources of Information |

Location and Size

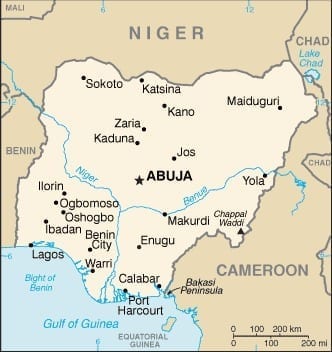

Nigeria is situated in West Africa. It borders the Gulf of Guinea and lies between Benin and Cameroon. The country has an area of 923.8 thousand sq. km. (356,700 sq. mi.) — about the size of California, Nevada, and Arizona.

Government

Nigeria is a federal republic with 36 states and one Federal Capital Territory (Abuja). Independence from the United Kingdom came October 1, 1960. Although both the 2003 and 2007 presidential elections were marred by significant irregularities and violence, Nigeria is currently experiencing its longest period of civilian rule since independence. The general elections of April 2007 marked the first civilian-to-civilian transfer of power in the country’s history.

Nigeria has a presidential system of government with a bicameral legislative National Assembly. There is an upper house (Senate) and a lower house (House of Representatives), as well as a judiciary. The President has very strong powers. A lack of governance and policy formulation has created multiple complex regulations at all three levels.

- Executive: President and Chief of State President Muhammadu BUHARI (since 29 May 2015); Vice President Oluyemi “Yemi” OSINBAJO (since 29 May 2015)

- Legislative: Bicameral National Assembly consists of the Senate and House of Representatives

- Judicial: Supreme Court (judges appointed by the President); Federal Court of Appeal

Legal System

Nigeria has a complex legal system composed of English common law, Islamic law, and Nigerian customary law. Most business transactions are governed by “common law” as modified by statutes to meet local demands and conditions.

Nigeria accepts compulsory ICJ (International Court of Justice) jurisdiction. (What does this mean?)

People

The most populous country in Africa, Nigeria accounts for over half of West Africa’s population.

- Population: 214,028,302 (July 2020 est.)

- Population growth rate: 2.53% (2020 est.)

- Languages: Approximately 510 living languages: English (official), Hausa, Igbo, Yoruba, Fulani, Kanuri have the largest number of native speakers

- Literacy: 62%

- Ethnic Make-up: Composed of more than 250 ethnic groups; the most populous and politically influential: Hausa and Fulani, Yoruba, Igbo (Ibo), Ijaw

- Religions: Muslim, Christian, indigenous African

Economy

The oil boom of the 1970s led Nigeria to neglect its strong agricultural and light manufacturing bases in favor of an unhealthy dependence on crude oil. In 2002 oil and gas exports accounted for more than 98% of export earnings and about 83% of federal government revenue, and Nigeria’s per capita income had plunged to about one-quarter of its mid-1970s high, below the level at independence.

Despite its strong fundamentals, oil-rich Nigeria has been hobbled by inadequate power supply, lack of infrastructure, delays in the passage of legislative reforms, an inefficient property registration system, restrictive trade policies, an inconsistent regulatory environment, a slow and ineffective judicial system, unreliable dispute resolution mechanisms, insecurity, and pervasive corruption. Regulatory constraints and security risks have limited new investment in oil and natural gas, and Nigeria’s oil production had been contracting every year since 2012 until a slight rebound in 2017.

Nigeria entered recession in 2016 as a result of lower oil prices and production, exacerbated by militant attacks on oil and gas infrastructure in the Niger Delta region, coupled with detrimental economic policies, including foreign exchange restrictions. GDP growth turned positive in 2017 as oil prices recovered and output stabilized.

Currency: Naira (NGN)

Leading Markets (2017): India 30.6%, US 12.1%, Spain 6.6%, China 5.6%, France 5.5%, Netherlands 4.4%, Indonesia 4.4

Leading Exports – Commodities: Petroleum and petroleum products 95%, cocoa, rubber

Leading Suppliers (2017): China 21.1%, Belgium 8.7%, US 8.4%, South Korea 7.5%, UK 4.4%

Leading Imports – Commodities: Machinery, chemicals, transport equipment, manufactured goods, food and live animals

Top Industries: Crude oil, coal, tin, columbite; palm oil, peanuts, cotton, rubber, wood; hides and skins, textiles, cement and other construction materials, food products, footwear, chemicals, fertilizer, printing, ceramics, steel, small commercial ship construction and repair

Agricultural Products: Cocoa, peanuts, palm oil, corn, rice, sorghum, millet, cassava (tapioca), yams, rubber; cattle, sheep, goats, pigs; timber; fish

Comparative Economic Indicators – 2018

| Nigeria | Niger | Cameroon | Benin | Chad | Central African Rep. |

|

| Population (millions)* | 214.02 | 22.77 | 27.74 | 12.86 | 16.87 | 5.99 |

| Population growth (%)* | 2.53 | 3.66 | 2.78 | 3.4 | 3.18 | 2.09 |

| GDP (USD billion) PPP*** | 1,121.0 | 21.86 | 89.54 | 25.39 | 28.62 | 3.39 |

| GDP per capita (USD) PPP*** | 5,900 | 1,200 | 3,700 | 2,300 | 2,300 | 700 |

| Economic growth (%)*** | 0.8 | 4.9 | 3.5 | 5.6 | -3.1 | 4.3 |

| Inflation*** | 16.5 | 2.4 | 0.6 | 0.1 | -0.9 | 4.1 |

| Unemployment rate (%)*** | 16.5 | 0.3 | 4.3 | 1.0 | N/A | 6.9 |

| Exports (USD billions)*** | 1,146.0 | 4.14 | 4.73 | 1.94 | 2.46 | 113.7 |

| Imports (USD billions)*** | 32.67 | 1.83 | 4.81 | 2.78 | 2.16 | 393.1 |

| Foreign debt (% of GDP)*** | 40.96 | 3.73 | 9.37 | 2.80 | 1.72 | 0.779 |

| Currency | Naira (NGN) |

Franc (XAF/XOF) |

Franc (XAF/XOF) |

Franc (XAF/XOF) |

Franc (XAF/XOF) |

Franc (XAF/XOF) |

| Exchange rates (per USD) on 2/12/20 | 363.0 | 601.1 | 601.1 | 601.1 | 601.1 | 601.1 |

| Exchange rates (per EUR) on 2/12/20 | 394.50 | 653.30 | 653.30 | 653.30 | 653.30 | 653.30 |

* 2020 estimates

**PPP – Purchasing Power Parity

*** 2017 estimate

Credit and Collections

Overseas Press & Consultants (OP&C) Evaluation

- Collection Experience: Fair

- Exchange Delays: 3 months

- Preferred Credit Terms: Confirmed letter of credit

- Minimum Credit Terms: Confirmed letter of credit

ABC-Amega’s Collection Experience in Nigeria

“While we can attempt to collect in Nigeria, the country is plagued by substantial fraud. Therefore, the prospect of collecting are always marginal and our prior experience has been nothing short of horrible, given the considerable corruption found on every level within the country.

“On the upside, we have recently found a new attorney in Nigeria who appears to be both honest and diligent in performance. He has also given our clients a choice, on specific cases, between filing a lawsuit or turning claims into potential criminal cases for fraud. A Nigerian government agency ” the Economic & Financial Crimes Commission (E.F.C.C.) ” has also been set up to determine if debts owed to foreign companies involve fraud on the part of Nigerian businesses. We hope this is an indication that the government is starting to turn things around. But it’s too soon to know if this is actually the case.

Our Nigerian attorney also tells us that getting a ruling from the E.F.C.C. is very time consuming and so is litigation, which is the only other remedy in such cases of fraud.

Dispute Resolution

Unfortunately, the Nigerian court system has too few court facilities, lacks computerized document processing systems, and poorly remunerates judges and other court officials, all of which encourages corruption and undermines enforcement. Even in cases where creditors obtain a judgment against defendants, claims often go unpaid.

Nigeria does have an Arbitration and Conciliation Act (of 1988) that provides for a unified and straightforward legal framework for the fair and efficient settlement of commercial disputes by arbitration and conciliation. The Act established internationally competitive arbitration mechanisms, fixed proceeding schedules, provided for the application of the UNCITRAL (United Nations Commission on International Trade Law) arbitration rules or any other international arbitration rule acceptable to the parties, and made the Convention on the Recognition and Enforcement of Arbitral Awards (New York Convention) applicable to contract enforcement, based on reciprocity.

Risk Assessment

Coface Country Risk Rating: C — A high-risk political and economic situation and an often very difficult business environment can have a very significant impact on corporate payment behavior. Corporate default probability is very high.

Credendo Political Risk Rating: 5.5 ” Ratings 1 through 7 with “1” being lowest risk and “7” being highest

Credendo Commercial Risk Rating: C ” highest risk

Business Climate

Nigeria offers investors abundant natural resources, a low-cost labor pool, and a potentially large domestic market. Unfortunately, much of that market potential is unrealized. Impediments to investment include inadequate infrastructure, corruption, an inefficient system of registering property, an inconsistent regulatory environment, restrictive trade policies, and slow and ineffective courts and dispute resolution mechanisms.

Apart from corruption, difficulties in accessing formal credit from the banking system, high crimes rate and the inconsistent public regulations are cited as obstacles to formal business. Furthermore, business in Nigeria has a bad reputation due to the widely known e-mail based ‘advance fee frauds’ committed by Nigerians. As a consequence, some Nigerian businesses register in neighboring countries or in the United Kingdom.

Social, ethnic and religious tensions have constituted a major deterrent to investors faced with an unfavorable business environment. Political and institutional weaknesses continue to be a substantial risk factor.

Transparency of Regulatory System: The administrative systems are unnecessarily complex, with overlapping authorities in many areas such as taxation and licensing. Nigeria’s regulatory system is consistent with international norms but enforcement is uneven and inadequate. Red tape, administrative barriers and delays are major constraints on business.

Intellectual Property: Nigeria is a member of the World Intellectual Property Organization (WIPO) and a signatory to the Universal Copyright Convention, the Berne Convention, and the Paris Convention. However, patent and trademark enforcement remains weak, and judicial procedures are slow and subject to corruption. Therefore, companies rarely seek trademark or patent protection and very few cases have been successfully prosecuted. Most cases are settled out of court, if at all.

Conversion and Transfer Policies: Foreign companies and individuals can hold domiciliary accounts in banks. Account holders have unlimited use of their funds, and foreign investors are allowed unfettered entry and exit of capital. Companies must provide evidence of income earned and taxes paid before making remittances. Money transfers usually take less than two weeks. All transfers are required by law to be made through banks, because banks are the only licensed foreign exchange agents.

Expropriation of Foreign Assets: Nigeria has not expropriated or nationalized foreign assets since the late 1970s.

Corruption: Corruption is considered the third most important obstacle for doing business in Nigeria by the World Economic Forum 2019, surpassed only by access to financing and inadequate supply of infrastructure. Various surveys report that households and companies consider corruption to be one of Nigeria’s most severe problems. Human Rights Watch 2019 has summarized the endemic nature of corruption in Nigeria in its estimate of the USD 380 billion lost to corruption from independence in 1960 to 1999.

The state level of governance is reported to be more corrupt than the federal level and has direct control of many areas important to businesses. The state agencies tend to impose a wide range of fees, licenses, fines and taxes arbitrarily.

Economic Freedom: According to the 2019 Index of Economic Freedom, Nigeria ranks 111th out of 157 countries and 14th out of 47 countries in the sub-Saharan region. It scores above average only in labor and fiscal freedom. It is 10 percentage points below average in business and financial freedom.

Political Violence: Social unrest, religious and ethnic strife, and crime affect many parts of Nigeria.

For more detailed information on these topics, visit the 2019 Investment Climate Statement ” Nigeria, of the U.S. Department of State.

Business Protocol

Business Cards: Business cards are important and you should include any advanced university degrees. Present and receive business cards with two hands or the right hand, never with the left. Do not write on your or another’s business card. Make a point of studying any business card you receive.

Business Attire: Conservative clothing is appropriate for business. Light-weight suits and short sleeve shirts for men and slack suits or dresses (not above the knee) for women.

Names and Titles: Address people initially by their academic, professional or honorific title and their surname. Always wait until invited before using someone’s first name.

Conversation: Generally speaking, Nigerians are outgoing and friendly, although communication tends to be indirect. Communication should commence with polite inquiries into the welfare of the person and his family.

Gifts: Gifts should be given using the right hand only or both hands. Gifts from a man to a woman must be said to come from the man’s mother, wife, sister, or other female relative, never from the man himself. Gifts are not always opened when received.

Meetings and Negotiations: Expect the first few meetings to be somewhat formal as your Nigerian counterparts continue to become comfortable with you as a person. It is a good idea to maintain a polite and somewhat reserved manner until the person you are meeting drops some of his formality.

Acceptable Public Conduct: Very direct eye contact may be interpreted as being intrusive unless there is a longstanding personal relationship.

Sources for further information on doing business in Nigeria

Economist Country Briefings: Nigeria ” recent articles of interest along with political and economic forecasts

Embassy of the Federal Republic of Nigeria – Washington, D.C.

Lagos Chamber of Commerce & Industry

**********

Subscribe to the Credit-to-Cash Advisor

Monthly e-Newsletter — It’s Free

This information is provided by ABC-Amega Inc. Providing international receivable management and debt collection services for exporters to more than 200 countries. For further information, contact [email protected].

This report represents a compilation of information from a wide variety of reputable sources.

Economic Indicators: Variety of sources including the CIA World Factbook, COFACE Country Ratings, Economist Country Briefings, Federation of International Trade Associations (FITA) Country Profiles.

Risk Assessment information: Provided with permission by Coface Country Rating. Also Belgian credit insurance company Ducroire Delcredere

Information on credit terms and the probability of prompt payment are provided, with permission, from Overseas Press and Consultants (OP&C) as published in IOMA’s Report on “Managing Credit, Receivables & Collections,” December 2007.

Historical Exchange Rates: OANDA.com The Currency Site.